Setting the Context

As the competition in RPA industry was heating up, in 2020, Microsoft’s acquisition of Softmotive laid the foundation of fundamental shifts in the industry. While Microsoft with Power Automate desktop flows, Power Automate Cloud flows, Power Apps and Power BI brought Power Platform to center stage larger software companies like SAP and PEGA recognized RPA as a segment that they wanted to invest in and get a share of the pie and some of the players that were not considered as leaders started losing the appetite to continue to invest and compete with the likes of Microsoft in future. Evidence of this is reflected by the fact that multiple players from the original 2019 analyst reports dropped from RPA focused analyst reports in 2020 like Another Monday, Datamatics, Kryon, Automation Edge and other larger players like SAP entered the industry and started showing up in the analyst reports.

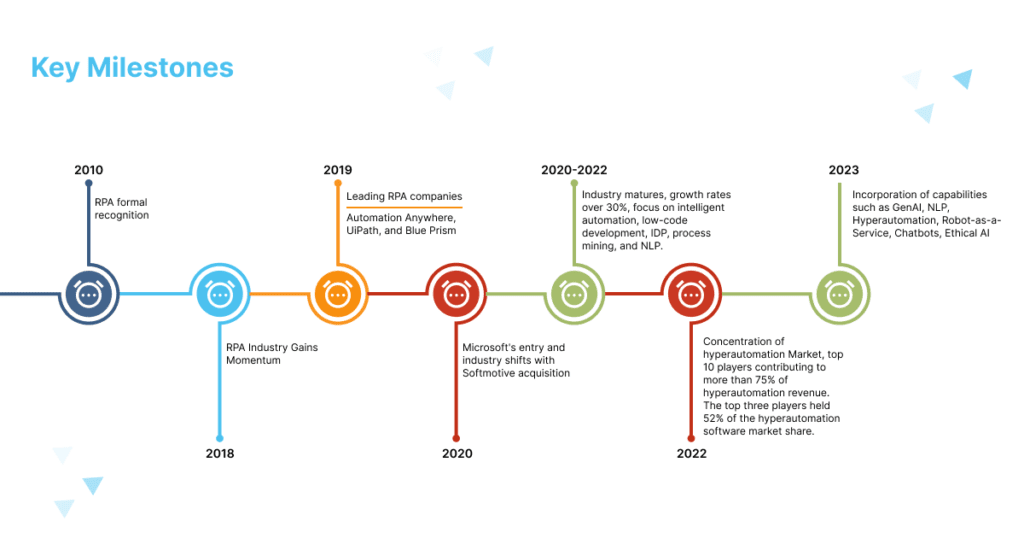

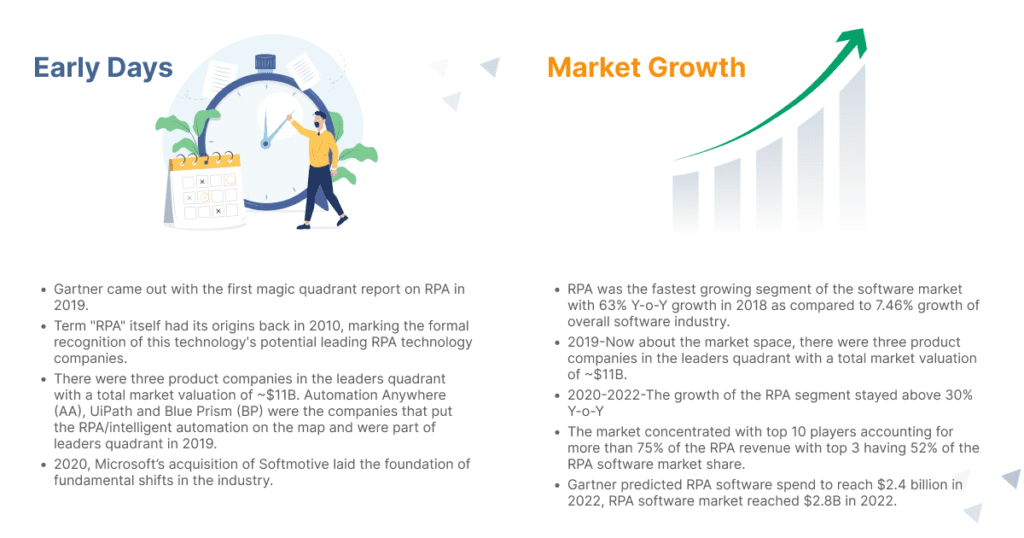

Early Days

While the term “RPA” itself had its origins back in 2010, marking the formal recognition of this technology’s potential leading RPA technology companies were no longer content with merely screen scraping; they ventured into the realm of metadata, driving modern third-party applications at the user interface (UI) level. The traditional boundaries were being pushed, and RPA was at the forefront of this change. Gartner came out with its first comprehensive report about RPA industry with the magic quadrants in 2019. The 2019 report still focused on defining RPA as to what it meant and more importantly what it didn’t because at the time there were still a lot of misconceptions about the capabilities of RPA.

Now about the market space, there were three product companies in the leaders quadrant with a total market valuation of ~$11B. Automation Anywhere (AA), UiPath and Blue Prism (BP) were the companies that put the RPA/intelligent automation on the map and were part of leaders quadrant in 2019. While these three pioneers continue to maintain their first mover advantage and are still in the leader’s quadrant today there were multiple companies that were part of the analyst reports like Kofax, NICE, Edgeverve, Automation Edge, Softmotive, Datamatics, Antworks to name a few. Some of them are still around and some have changed course as developed their own niche space in the market.

As the competition in RPA industry was heating up, in 2020, Microsoft’s acquisition of Softmotive laid the foundation of fundamental shifts in the industry. While Microsoft with Power Automate desktop flows, Power Automate Cloud flows, Power Apps and Power BI brought Power Platform to center stage larger software companies like SAP and PEGA recognized RPA as a segment that they wanted to invest in and get a share of the pie and some of the players that were not considered as leaders started losing the appetite to continue to invest and compete with the likes of Microsoft in future. Evidence of this is reflected by the fact that multiple players from the original 2019 analyst reports dropped from RPA focused analyst reports in 2020 like Another Monday, Datamatics, Kryon, Automation Edge and other larger players like SAP entered the industry and started showing up in the analyst reports.

Transition to Maturity

Now let’s look at how the key technology companies in the segment did during this transition period. The three original pioneers of the industry i.e., Automation Anywhere, Blue Prism and UiPath have continued their position in the leader’s quadrant with Blue Prism going public & then being acquired in 2021 and UiPath going public in 2021. There have been just two additions to the leaders’ list in most analyst reports. NICE entered the leader’s quadrant in 2022 with its RPA product NEVA that focuses on attended automation for global contact centers.

NICE continues to use NEVA as a complimentary technology for their broader product portfolio that focuses on contact center experience. Microsoft, with its acquisition of Softmotive and with continued investment, entered the leader’s quadrant in 2021 and has stayed there since then. Microsoft’s, with its large enterprise customer base, has gained a lot more traction with a lot of companies and we see this in our client base as well. Some of the other RPA companies, like NICE, have found their niche and are stable now in their market positioning for eg. Datamatics, Antworks and Kofax focus more on their IDP platform than on the core RPA capabilities and SAP, Appian, Salesforce & Pegasystems largely focus on their existing customer base with RPA being a complimentary technology to their main line of business.

Conclusion

Let me conclude by saying that RPA or Intelligent Automation or Hyperautomation, whichever name we use, as an industry has reached a maturity point where scale of deployments is large and most of the large enterprises are continuing to make incremental improvements in their Hyperautomation landscape. The customer base has shifted from more business lead buying to IT or COE lead buying and management.

The increased scale of automation deployments has brought to light a few challenges that the organizations are facing a) the increased complexity of deployments with multiple technologies and (or) multiple instances of same technology making it difficult to monitor the automations to ensure they are delivering the value b) with the focus of management shifting from business teams to COE or IT teams the need to show transparently that automations are being managed has become very important and c) COE teams are being challenged to optimize the team or effort being used to monitor and manage the automation landscapes.

We, at Acronotics, have built an AI based platform, Radium AI, that uses the power of artificial intelligence to address these challenges that come with scale. Radium automates the monitoring, maintenance and support of digital workers running on multiple instances of different technologies. Radium makes it easy to manage the enterprise-wide digital workforce and significantly reduces the effort and cost of RPA support. We have started the product journey with RPA technologies and are working on growing the digital workers built in different technologies like intelligent data processing like Abby, Kofax etc. and chatbots like MS power virtual agent, Kore.ai etc. Radium is not just a product but a vision of self-governed digital workers across companies in the automation industry.